The Nucleic Acid Testing Industry: Rapid Growth Driven by Technological Advances and Increasing Demand for Precision Diagnostics

Nucleic acid testing (NAT) has become an important technology in molecular diagnostics and clinical laboratories. It involves the detection of DNA or RNA to diagnose infectious diseases, genetic disorders, and various cancers. The global nucleic acid testing market has grown rapidly in recent years and is expected to continue to grow due to various factors.

Overview of the Nucleic Acid Testing Market

The global nucleic acid testing market is estimated at USD 3.7 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) ~의 6.8% from 2023 에게 2033 (future Marketing Insights).

North America accounted for the largest revenue share of 38.21% in 2022 and will retain its lead over the forecast period (Cognitive Market Research). The high prevalence of target diseases, presence of key players, advanced healthcare infrastructure, and favorable regulatory scenario are factors driving the North American nucleic acid testing market.

The Asia-Pacific genetic testing market is estimated to grow at a CAGR of 7.65% from 2023 에게 2028, reaching a market size of USD 4.11 billion by 20285. India, 중국, and Japan are the key countries in this market, with China and Japan expected to account for a promising share of the APAC market(Market Data Forecast)

Another study projects the Asia-Pacific emerging infectious disease diagnostics market to reach $10.83 billion by 2033(Market Watch)

Key Drivers of the Nucleic Acid Testing Market

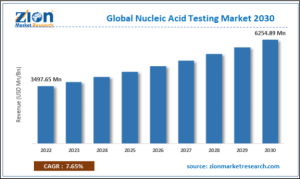

~ 안에 2022, the market was valued at approximately $3.5 billion. By 2030, analysts forecast the market will reach around $6.3 billion, reflecting a compound annual growth rate of 7.65% between 2023 그리고 2030. This anticipated growth indicates rising demand for nucleic acid tests and expansion in the sector (Zion Market Research)

Several factors are contributing to the rapid growth of the global nucleic acid testing market including:

Rising infectious diseases:

Growing cases of illnesses like HIV, hepatitis, hospital infections, flu, and tropical diseases are increasing the demand for nucleic acid tests that can quickly and accurately identify pathogens. Around 1.3 million people died from tuberculosis and 10.6 million people became ill with the disease in 2020. (WHO) Such a high disease burden is driving the uptake of NAT.

Increasing cancer prevalence:

Cancer rates continue to rise globally about 10 million deaths in 2020. (WHO) Nucleic acid tests can detect cancer-linked genetic mutations, allowing earlier diagnosis and treatment personalization. This boosts test usage in oncology.

Report Coverage and Details:

| Report Coverage | 세부 |

| Forecast Period | 2023-2032 |

| Bose Year | 2022 |

| Market Size in 2022 | 4.8 Billion |

| Market Size in 2052 | $9.1 Bdlio |

| CAGR | 6.6% |

| No of Poges in Report | 272 |

| Segments Covered | 기술, 애플리케이션, End User, and Regina |

| Drivers | The surge in demand for advanced diagnostic techniques |

| The rise in incidences of infectious diseases | |

| Growth in the prevalence of cancer causes | |

| Opportunities | Rising awareness and demand for point-of-care testing |

| Restraints | Lack of awareness regarding advanced diagnostic techniques |

| Lack of skilled personnel for advanced diagnostic testing |

Technological improvements:

오토메이션, simplified workflows, faster turnaround times, and point-of-care tests expand the accessibility and adoption of nucleic acid testing in healthcare settings.

Growth in forensics:

Nucleic acid testing is being used more in forensics for parentage testing, human identification, and investigating disease outbreak origins. Microbial DNA profiling also relies on these tests. (National Library of Medicine).

Use Applications of Nucleic Acid Testing

Nucleic acid testing has become indispensable across many research and medical fields. Some of its major uses are:

Detecting the presence of viruses and other pathogens in patient samples. Specialized nucleic acid tests can identify the unique genetic material of viruses like SARS-CoV-2, enabling accurate diagnosis of infectious diseases (National Library of Medicine).

Genetic testing to identify disease-causing mutations and chromosomal abnormalities. Techniques like polymerase chain reaction (PCR) have made genetic testing much faster and more precise. This helps diagnose genetic disorders earlier(National Library of Medicine)

Drug discovery research to develop new treatment approaches. Scientists modify nucleic acids to create experimental drugs that can silence or alter disease-linked genes. These may offer new therapeutic strategies(BMC Biology)

Diverse biotechnology applications from biosensors to gene editing. Nucleic acids provide a versatile biomaterial platform for innovations in fields like synthetic biology. Their stability makes them ideal for use outside living cells(BMC Biology).

Rapid on-site diagnostics for point-of-care testing. New microfluidic chips integrate sample processing and analysis, enabling quick nucleic acid testing in clinics, homes, or disaster sites. This allows faster clinical decision-making(frontiers)

Nucleic Acid Testing Market Scope:

| Market Size in 2022 | USD 3497.65 Million |

| Market Forecast in 2030 | USD 6254.89 Million |

| Growth Rate | CAGR of 7.65% |

| Number of Pages | 231 |

| Key Companies Covered | Thermo Fisher Scientific, Roche Diagnostics, Hologic, Luminex Corporation, Qiagen, DiaSorin, Bio-Rad Laboratories, BioMerieux Abbott Laboratories, Grifols, Cepheid, Siemens Healthineers Exact Sciences Corporation, 다른 사람. |

| Segments Covered | By Indication, By End-User Verticals, By Product Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific(APAC), Latin America Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 에게 2021 |

| Forecast Year | 2023-2030 |

Nucleic Acid Testing Market: Regional Outlook

North America is poised to see the highest growth rate in the coming years driven by its advanced medical infrastructure and innovation in diagnostic testing.

~ 안에 2018, the University of Glasgow received $1.85 million in U.S. funding to conduct rapid testing in remote locations and develop new tests for parasitic diseases, exemplifying America’s support for advancing NAT technology. North America also has a robust ecosystem for personalized medicine, with Pfizer predicted to lead in customized therapeutics including for infectious diseases. (Zion Market Research)

In July 2023, Pfizer announced a $100 million investment with Flagship Pioneering to develop 10 potential novel drugs leveraging NAT, underscoring North America’s commitment to advancing nucleic acid testing innovation. (Zon Market Research)

With its deep resources, research infrastructure, and ecosystem of leading companies, North America is poised to drive cutting-edge advancements in nucleic acid testing in the years ahead.

Nucleic Acid Testing Prominent Market Players

The nucleic acid testing industry has several major companies competing for market share globally. Some of the top players are:

Abbott Laboratories

A diverse healthcare company and leader in molecular diagnostics. Abbott offers various FDA-approved nucleic acid tests spanning infectious disease, oncology, 유전학, and pharmacogenetics(Mordor Intelligence).

bioMérieux

A French biotech company focused on in vitro diagnostics. bioMérieux provides extensive nucleic acid testing solutions including reagents, instruments, and software for infectious diseases, cancers, and other pathologies(Fortune Bussiness Insights)

Hoffmann-La Roche

A Swiss healthcare company and leader in in vitro diagnostics. Roche offers a broad menu of nucleic acid tests on its cobas systems spanning HIV, hepatitis, HPV, and SARS-CoV-2 detection.(Mordor Intelligence)

Bio-Rad Laboratories

A key player in nucleic acid analysis and amplification technologies. Bio-Rad’s droplet digital PCR and CFX real-time PCR systems enable highly sensitive nucleic acid quantification.

Grifols

A Spanish company specializing in transfusion medicine and diagnostics. Grifols develops NAT solutions for blood and plasma screening, including the Procleix system and Ultrio assay that simultaneously detects HIV, HCV, and HBV in donors.

Hologic

An American medical technology company. Hologic’s nucleic acid testing products include the Panther and Panther Fusion systems providing automated sample-to-result workflows for sexually transmitted infections.

Illumina

A leading company in next-generation sequencing and array technologies. Illumina provides NGS instruments and consumables to support sequencing applications from reproductive health to cancer.(Mordon Intelligence)

Future Outlook

Recent reports indicate promising growth ahead for the nucleic acid testing industry. The global market is forecast to reach $6.7 billion by 2030, growing at a 6.8% compound annual rate from 2023-2030(Global Newswire). This growth will be driven by rising demand for nucleic acid tests to detect growing cases of genetic disorders, 암, and infectious diseases. There is also an increasing need for effective testing methods to manage disease outbreaks. (Future Market Insights) The market for nucleic acid amplification tests specifically is highly competitive, with many companies developing new test types in recent years.

현재, North America and Europe represent the largest nucleic acid testing markets. 하지만, Asia Pacific is expected to see faster growth rates going forward due to improving awareness and healthcare access in the region leading to higher adoption of testing. (Fortune Business Insights) The future outlook is positive for nucleic acid testing as the prevalence of target diseases increases globally. Market expansion will be fueled by new product development and rising demand in emerging markets. Key players are focused on introducing innovative testing solutions to gain a share in this competitive space.

결론

결론적으로, the nucleic acid testing industry will continue its robust growth trajectory driven by rising demand for precision diagnostics, genomics research advances, and molecular testing technologies. Widespread adoption of NAT across diverse healthcare and life science applications will cement its position as a fundamental pillar of medical diagnostics worldwide.